On Wednesday, the California Senate Banking and Financial Institutions Committee and the Assembly Banking and Finance Committee held a joint oversight hearing on the failure of Silicon Valley Bank to evaluate and raise questions about the adequacy of banking regulations and effectiveness of state regulatory supervision.

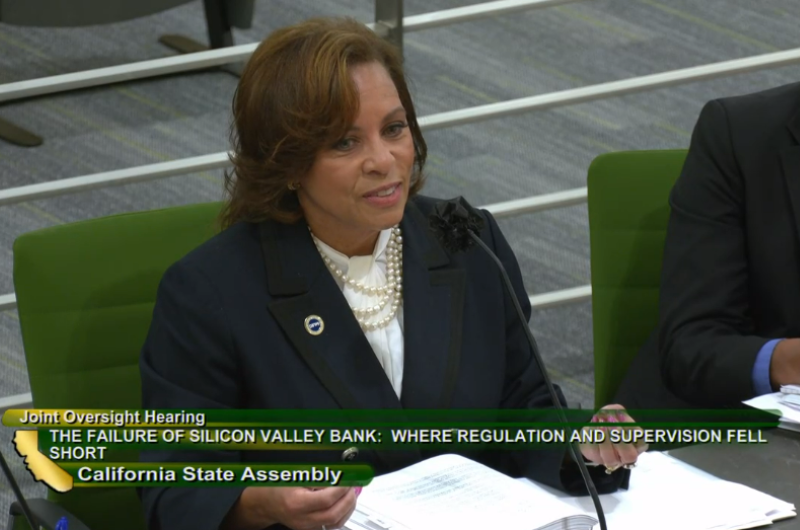

California Department of Financial Protection and Innovation (DFPI) Commissioner Cloey Hewlett gave a timeline overview of the bank’s failure, as well as the DFPI’s actions in coordination with response from federal financial regulators.

Hewlett also noted she is committed to focusing on changes within the DFPI’s processes and procedures. She recognized the agency needs to increase focus and supervision of large state-chartered banks and acknowledged that smaller community and regional banks should not be subject to the same standards for larger institutions.

Senate and assembly committee members asked questions about various topics, including Silicon Valley Bank leadership repercussions, uninsured deposits, the dual banking system, and what additional oversight the state can provide to help prevent future bank failures.

Throughout the hearing, it was acknowledged the bank’s collapse was caused by failed bank leadership — and that even though there’s shared responsibility between state and federal regulators, California needs to look at what role the state can play moving forward.

DFPI’s SVB Report: Oversight, Regulation & Supervision

Earlier this week, the DFPI released the following report: Review of DFPI’s Oversight and Regulation of Silicon Valley Bank.

It summarizes the department’s supervision of Silicon Valley Bank and reviews circumstances leading to its failure, including the following:

The DFPI has also posted confidential supervisory information about Silicon Valley Bank — including examination report summaries, supervisory letters, and ratings downgrades — so policymakers and the public are fully informed about the circumstances leading to the bank’s demise.

2855 East Guasti Rd., Suite 202

Ontario, CA 91761

909.212.6000

1201 K. St., Suite 1050

Sacramento, CA 95814-3992

916.325.1360

c/o Great Basin FCU

9770 South Virginia Street

Reno, NV 89511-5941

202.638.5777 www.cuna.org

www.dfpi.ca.gov

Clothilde “Cloey” V. Hewlett — 415.263.8500

fid.state.nv.us

702.486.4120 (Las Vegas)

775.684.2970 (Carson City)