Just in time for Financial Capability Month, the Richard Myles Johnson (RMJ) Foundation has launched an updated feature to the Bite of Reality2 app: Pay Yourself First. Students now have the opportunity to set aside funds into their savings account before they begin to visit the merchant stations to make purchases for their monthly needs such as transportation, childcare, and housing.

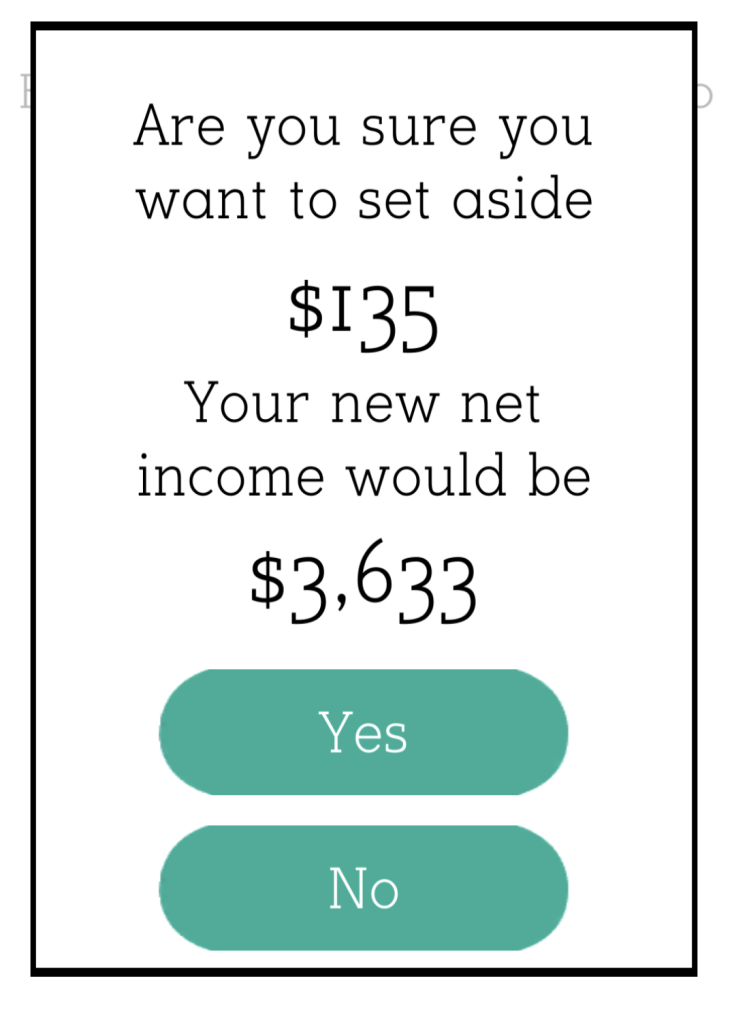

Saving is an important aspect of budgeting, however, the exercise only allowed students to put money into their “savings account” at the end of the program, if they had funds remaining. With this new feature incorporated into the Bite of Reality 2 App, students receive a prompt allowing them to choose to set aside savings before they begin “shopping.” Launched on March 1, the new feature seems popular with students, with the majority opting to put funds into their savings accounts before they begin visiting the merchant tables.

So far in 2023, the Bite of Reality program has seen year-over-year growth, approaching pre-pandemic levels in California and Nevada. In March alone, 17 credit unions in California and Nevada delivered 34 Bite of Reality events, reaching 5,500 students. Nationwide, some 10,000 students went through the program in March.

Bite of Reality is a hands-on app-based simulation that appeals to teens while giving them a taste of real-world financial realities. Teens are given a fictional occupation, salary, credit score, spouse and a child, student loan debt, credit card debt, and medical insurance payments. The teens then walk around to various table-top stations to “purchase” housing, transportation, food, clothing, and other needs. Fortunately, the game also includes a “credit union” to help with their financial needs.

This interactive activity teaches teens how to make financial decisions and give them a better understanding of the challenges of living on a budget. Teens have to deal with a pushy “car salesperson” and a commission-based “realtor,” and weigh their wants versus their needs. There’s even a “Fickle Finger of Fate” that gives the students unexpected “expenses” or “windfalls”—just like in real life.

For more information or to book your first event, contact Jenn Lucas at info@rmjfoundation.org.

The RMJ Foundation is the California and Nevada Credit Union Leagues’ primary financial literacy partner.

Article provided by RMJ Foundation.

2855 East Guasti Rd., Suite 202

Ontario, CA 91761

909.212.6000

1201 K. St., Suite 1050

Sacramento, CA 95814-3992

916.325.1360

c/o Great Basin FCU

9770 South Virginia Street

Reno, NV 89511-5941

202.638.5777 www.cuna.org

www.dfpi.ca.gov

Clothilde “Cloey” V. Hewlett — 415.263.8500

fid.state.nv.us

702.486.4120 (Las Vegas)

775.684.2970 (Carson City)