Heritage — Purpose — Excellence

For more than 90 years, we have undergone a remarkable transformation. What initially began as a modest volunteer organization in 1933 with a specific political agenda has evolved into a well-established, highly skilled, and professional association.

Our story from 1933 is your story. It’s one of commitment, dedication, exhilaration, and at times, despair. It’s a journey through the eyes of individuals who fell in love with ideals and spent their lives helping others discover the great credit union story.

Today, our dedicated leaders offer a wide range of educational, informative, and advocacy services — working to secure significant victories that empower credit unions to make meaningful differences in people’s lives. As we look to the future, we do so through the lens of the past. Legacy and leadership aren’t just about envisioning tomorrow, as it is important to applaud the dedication and persistence of those preceding us.

Keeping our heritage alive is a labor of love as we remain committed to credit unions — for all the years and decades past, and all the decades to come. Join us to celebrate our story as we recognize where we’ve come from to appreciate where we are going!

1920 – 1939

The ‘Father’ of Our Movement

Leo Shapiro, the “father” of our movement in California, organized over 100 credit unions while managing a robust law practice and serving as the California Credit Union League’s chief political lobbyist in Sacramento. In his eventual role as the League’s first president, his passion for freeing families from harmful lending practices led to a five-year battle in advocating for a state law to establish credit unions.

Success was struck with the California Credit Union Law of 1927. While Fresno Postal Employees Credit Union formed as California’s first credit union in 1924 using other states’ laws for guidance, it reorganized in 1929 into Fresno Postal Credit Union under this new 1927 law. Credit unions were chartered for postal, telephone, railroad, utility, grocery, educational, civic, and so many other employee groups. The Federal Credit Union Act of 1934 also added national legitimacy.

In 1933, the impetus behind the League’s formation was the State Corporation and Franchise Tax Act, which would have forced a 6 percent tax on all “above the line” income. We came together each year for many reasons, but this new law was a key initiator.

Twenty-three member credit unions attended the League’s first annual meeting on February 16th, 1935, with our organization’s office headquartered in Oakland in 1937.

1940 – 1949

Helping Others Help Themselves

Political strategy was essential as the California Credit Union League found its footing in Sacramento during the state’s annual legislative sessions, as well as fostering our alliance with the Credit Union National Association.

League board and committee meetings were in focus as each year brought new questions from members about presidential terms of office, board of director and organizational structure, local chapters (today’s League Networks), the member-dues schedule, and other operational challenges. Agreements and disagreements alike were debated as growing pains positioned credit union colleagues in working relationships.

Most of the League’s work would be accomplished by committed volunteers in the 1940s, a trend from the 1930s and continuing into the 1950s. Analyzing bills, as well as perfecting laws and regulations, was always the goal, with an eye toward how credit unions could continue thriving as they used new and different means to serve members.

1950 – 1959

Finding Our Cooperative Spirit

It was clear credit unions had been doing what not all banks could profess: serve consumers equally. We had subdued bankers’ obsession with pulling the rug from underneath our movement. We had accomplished this in a financially safe and sound manner — and with private insurance.

Many credit union advocates were involved in sounding the alarm on hostile legislation in Sacramento and Washington, D.C. — but others were not. Some credit union managers felt there was little or no benefit to being part of our association.

Proving to this smaller group that a unified voice shows strength in numbers in the state capitol and U.S. Congress took effort, but it was worth it. Many of their peers that were members had joined the League before they were even granted a legal charter. That’s how powerful cooperation had become between the League, its members, and the endeavors at hand. It eventually spoke volumes to other credit unions.

In 1958, the Filene Educational Foundation was formed, the League’s first-ever foundation that focused on philanthropy in education. It was a huge step for a growing movement. It was only the beginning of more credit union goodwill to come.

1960 – 1969

Enigmatic Spirit, Growth, and Drama

Edward Filene became one of the most formidable names in capitalism, philanthropy, and credit unions. He was known as “a most unassuming millionaire” as he campaigned to organize credit unions across the nation and in California.

Although Ed passed in the 1930s, the 1960s was a crucial period for the California Credit Union League as his legacy began to yield notable future results. Business was booming in League-hosted professional development and chapter engagement (today’s League Networks), all contributing to credit unions’ appetite to serve members better. Educational opportunities and spirited gatherings were routine, and Western CUNA Management School was founded to develop credit union leaders. New League services emerged as member credit unions made a splash into being fast followers of technology.

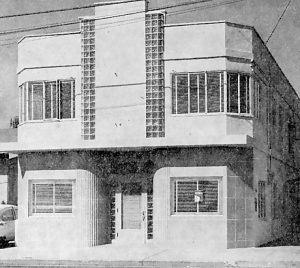

The League eventually moved to a larger office building in Pomona, California in 1963, joined by then-CUNA Mutual (today’s TruStage).

In 1969, the Nevada Credit Union League was formed by local leaders in the Silver State. Its entrance on the credit union association stage would eventually have implications for both the Nevada League and California League — but not for another 27 years.

1970 – 1979

Communication, Technology, and Corporates

The 1970s was a period of new advertising, marketing, newsletter, and technological efforts as the California Credit Union League kept credit unions constantly up to date. This was especially true when federally chartered credit unions were handed their first national regulator: the National Credit Union Administration.

Our League’s grassroots political arm was increasingly flexing its muscle as support from local credit union members increased. Internationally, global credit union collaboration reached new heights as relationships across oceans were being made that provided a synergy to reach more individuals. The early seeds were planted for future worldwide philanthropic efforts such as CU Aid.

The League was serving 1,800 credit unions through nearly 40 local chapters (today’s League Networks). In addition to employees trading notes on serving members and back-office processes, their credit unions were growing from a balance-sheet standpoint. Operational, clearing, and payment settlement needs became front and center. WesCorp (Western Corporate Federal Credit Union in San Dimas, California) sprang up among the 35 U.S. “corporate credit unions” that existed by 1977 to serve those needs.

1979 was the last year the League sponsored its “Miss Credit Union Contest,” which saw a healthy 21-year run (1959 – 1979).

1980 – 1989

Growing Complexity and Greater Coordination

The introduction of federal deposit insurance for credit unions ushered in a new era. Highly involved in these issues, the California Credit Union League and its member credit unions entered a period of banking deregulation.

This provided fuel for serving new members in the same regions or expanding to completely new geographies, all coming to a head with the bankers in the decade to-come in Congress and the U.S. Supreme Court. Our credit union “movement” was becoming a bonified industry as the National Credit Union Administration dispatched regional examiners and issued rules and regulations, with the League and the Credit Union National Association partnering consistently on Capitol Hill. By the mid-1980s, many in Congress were mumbling about “the little people” being shut out of mainstream financial services.

The gloves came off in news headlines as banks tried to persuade society that the U.S. government “subsidizes” credit unions through our not-for-profit federal corporate income tax benefit. The League shot back at every opportunity.

1990 – 1999

Political Advocacy Takes Center Stage

The California Credit Union League’s love of politics grew when Congress considered taxing credit unions (again) and folding the National Credit Union Share Insurance Fund into the bankers’ Federal Deposit Insurance Corporation. Once again, the League and the Credit Union National Association turned the tide.

The onslaught continued as bankers sought to narrow credit unions’ experimentation with serving multiple-group “bonds” of consumers, an issue eventually reaching California’s doorstep. This led to brave rallies and advocacy in Washington, D.C., and it ended with congressional passage of the Credit Union Membership Access Act of 1998.

The League’s California League Services Corporation (CLSC) became the first credit union service organization (CUSO) in the state to help deliver technical information, consumer materials, financial products, and several other valuable services. Industry partnerships were strengthened to take credit union offerings to the next level.

The Nevada Credit Union League entered into a management agreement with us, creating the California and Nevada Credit Union Leagues on January 1st, 1996 — joining forces to address legislative, regulatory, and other important issues specific to each state. This special relationship is reinforced each year during the Leagues’ annual meetings, as both states’ board of directors continue standing together in championing the credit union cause.

2000 – 2023

We are Honored to Continue Serving YOU

Branches versus online banking. Mobile convenience and fintech competitors. Faster payments, cybersecurity, and cryptocurrency. Artificial intelligence in lending. Serving the underserved and promoting financial wellbeing.

In all these areas, the California and Nevada Credit Union Leagues continues to chart new territory so our industry can continue evolving over the next decade of innovations. Today, 222 credit unions are members of the Leagues, representing 93% of all credit union assets (combined) in California and Nevada. From our offices in Ontario and Sacramento (California), we continue fulfilling our original mission.

Together, we transform our members’ lives and stand with a unified voice in the capitol halls of Sacramento, Carson City, and Washington, D.C. As we celebrate our 90th anniversary this year, join our movement and industry by celebrating with us!

We look forward to future decades with you as we come together each year at REACH to remember why credit unions were formed. We are honored to serve YOU!

2855 East Guasti Rd., Suite 202

Ontario, CA 91761

909.212.6000

1201 K. St., Suite 1050

Sacramento, CA 95814-3992

916.325.1360

c/o Great Basin FCU

9770 South Virginia Street

Reno, NV 89511-5941

202.638.5777 www.cuna.org

www.dfpi.ca.gov

Clothilde “Cloey” V. Hewlett — 415.263.8500

fid.state.nv.us

702.486.4120 (Las Vegas)

775.684.2970 (Carson City)