Credit Union History

Credit Union History

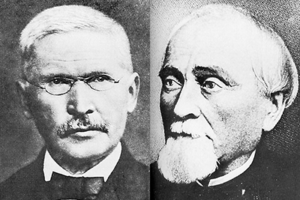

Friedrich Wilhelm Raiffeisen and Hermann Schulze-Delitzsch, were responsible for creating the first true credit unions in Germany in 1852 and 1864. During 1849, Raiffeisen founded a credit society in Flammersfeld, Germany, but it depended on the charity of wealthy men for its support. Raiffeisen remained committed to that concept until 1864, when he organized a new credit union along principles still fundamental today.

The Idea Goes West

It was a Canadian who transplanted the credit union to the Western Hemisphere. In 1900, Alphonse Desjardins organized a credit union (caisse populaire) in Levis, Quebec. The reasons were the same as those in Germany 50 years before. People were poor, interest rates were financially crippling, and the credit union offered a way out.

That first Canadian credit union was small by modern standards. The first savings deposit was only 10 cents; the first collection from all the members totaled only $26. Even today, in some countries, credit unions start small.

But Desjardins persevered and devoted a good part of his life to credit union development in North America. He founded other credit unions, including the first one in the United States, in 1909 in New Hampshire.

Jay, Filene—The U.S. Overture

Two Americans became profoundly influenced by Desjardins’ efforts: Pierre Jay, the Massachusetts banking commissioner and Edward A. Filene, a Boston merchant.

Filene discovered credit unions in a village in India in 1907. He had stopped in Calcutta and met a government official who took Filene out into the countryside. There Filene first observed a village credit union in operation and was immediately interested. Back home again, he began reading about credit unions to strengthen his knowledge.

Filene was perhaps the ideal American to give the credit union idea a push. He was a progressive thinker for his time. He had begun profit-sharing plans for his employees, instituted other novel fringe benefit programs, was the founder of the “bargain basement” idea in department store operation, allowed his employees to engage in collective bargaining and arbitration,established minimum wages for female workers, and advocated a five-day, 40-hour week. In the early 1900s, such ideas were revolutionary. Besides his creative approach to business, Filene was also one of the founders of the U.S. Chamber of Commerce.

As banking commissioner, Pierre Jay had made a study of unauthorized banking practices in Massachusetts. He learned that several groups of employees in the commonwealth had started their own savings and loan organizations. These groups resembled what Henry Wolff, a European, had described as “people’s banks.” Jay believed that these small associations were providing a needed service, but he wanted to recommend a way to make them legal.

From Wolff’s writings, Jay turned to the work of Desjardins and others. He began a chain of correspondence with Desjardins. This resulted in a 1908 conference in Boston in which Desjardins, Jay, Filene and other public-spirited citizens participated. Working with Desjardins, Jay prepared the legislation for what was to become the first general state credit union act in the United States.

Credit Union History

Credit Union History

Credit

Credit