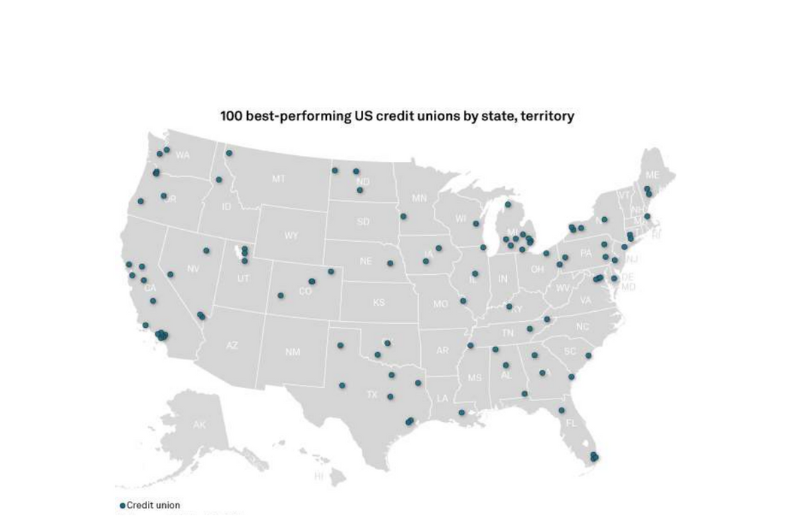

Sixteen credit unions across California and Nevada are part of S&P Global Market Intelligence’s 100 annual top-performing U.S. credit union list published this week.

California led the nation with 12 credit unions in the top 100, followed by Michigan with nine and Texas with eight. The top credit union headquartered in California (Long Beach Firemen’s CU) came in fifth, jumping from the 85th spot last year.

The top-performing credit union in Nevada — at No. 61 in the nation — is Financial Horizons CU (Hawthorne, NV).

The analysis used five financial performance metrics to identify top-performing U.S. credit unions by applying equal weights to each metric.

It also reviewed top-performing small and regional community U.S. banks (click here for more), as well as rankings by locality, including West, Midwest, South Central, Northeast, and Southeast.

Top Performing CA Credit Unions

California’s 12 credit unions include:

Top Performing NV Credit Unions

Nevada’s four credit unions include:

Top Spots Across the Nation

Eastman CU’s 6.6 percent member growth (Tennessee) was more than double the top 100 median of 2.3 percent. Its approximately $21,006 shares-and-deposits per member ratio was also higher than the top 100 median of $19,746.

The credit union’s return on average assets (ROAA) rose 18 basis points year over year to 1.98 percent — the 10th-highest among the top 100 credit unions. Its net worth ratio, while lower than the top-100 median of 15.17 percent, rose 101 basis points year over year to 13.98 percent.

Cascade Community FCU (Oregon) took the second spot with membership growth of 5.2 percent in 2023. It also had one of the lowest delinquent loan ratios at just 0.01 percent. Nebraska Energy FCU (Nebraska) climbed to the third spot from No. 52 the year prior, reporting 6.1 percent member growth in 2023. Its net worth ratio increased 270 basis points year over year to 17.88 percent.

WCLA CU (Washington) came in fourth, up from No. 49 the year prior. The credit union’s shares and deposits per member of $63,133 was the highest among the top 100 credit unions. However, its delinquent loan ratio was the third-highest among the top 100 credit unions, rising 75 basis points year over year to 0.90 percent, while its ROAA (return on average assets) decreased 64 basis points year over year to 1.54 percent.

WCLA CU serves the forest products industry, and almost 83 percent of its loan book at the end of 2023 consisted of commercial loans and lines of credit not secured by real estate.

Nineteen of the 50 top-performing credit unions from the prior year retained a place in the 2023 ranking. Multipli CU (Missouri), which took the top spot the year prior, fell to No. 686 after its profitability and membership declined in 2023. The credit union’s ROAA fell 59 basis points year over year to 1.05 percent, while its member count fell 9.9 percent in 2023, compared to 1.6 percent growth the year prior.

The United States’ largest credit union by assets, Navy FCU (Virginia), came in at No. 1,113, down from No. 476 the year prior. The credit union’s net worth ratio fell 58 basis points year-over-year to 11.71 percent, and its ROAA fell 38 basis points year over year to 0.82 percent.

Schlumberger Employees CU (Texas) was the top credit union in the Lone Star State, jumping from the 133rd spot the year prior to sixth in 2023. Consumers Professional CU (Michigan) came in seventh, making it the top Michigan-based credit union.

* Data compiled March 6, 2024. The mean for each metric was identified across the data set, and standard deviations from these means were calculated for each metric for each institution and aggregated to determine a relative performance score.

**Analysis includes U.S. credit unions with more than $100 million in assets and a net worth ratio of at least 7 percent as of December 31, 2023.

***Deposits (shares) are limited to balances attributable to members.

****Delinquent loans include loans that are at least 60 days delinquent.

2855 East Guasti Rd., Suite 202

Ontario, CA 91761

909.212.6000

1201 K. St., Suite 1050

Sacramento, CA 95814-3992

916.325.1360

c/o Great Basin FCU

9770 South Virginia Street

Reno, NV 89511-5941

202.638.5777 www.cuna.org

www.dfpi.ca.gov

Clothilde “Cloey” V. Hewlett — 415.263.8500

fid.state.nv.us

702.486.4120 (Las Vegas)

775.684.2970 (Carson City)