During this year’s Hike The Hill, 38 passionate credit union leaders from California and Nevada traveled to Washington, D.C. to meet with regulators, legislators, and their aides to discuss the credit union difference — highlighting the harmful effects of the Credit Card Competition Act and discussing other policies important to credit unions.

Regulatory Meeting Recap

On the regulatory side, attendees met with U.S. Treasury Department Assistant Secretary Graham Steele, as well as five staff members of the Consumer Financial Protection Bureau (CFPB). Topics with the Treasury included Central Bank Digital Currency (CBDC), Community Development Financial Institutions Fund (CDFI) Application Revisions, the Emergency Capital Investment Program (ECIP), and financial wellbeing and inclusion.

During the CFPB meeting, credit union leaders discussed regulatory burden, open banking/1033 rulemaking (Section 1033 of the Dodd–Frank Wall Street Reform and Consumer Protection Act), so-called “junk fees” and “surprise fees,” and regulation by enforcement.

CFPB and Treasury Department leaders listened to the issues credit unions laid before them, taking notes and acknowledging concerns the industry has with a handful of regulatory actions and other related items that hinder credit unions in serving their members and local communities across both states.

Congressional Recap

On the legislative side, credit union leaders met with four U.S. Senate offices and 38 offices in the House of Representatives. Overall, credit union advocates from California and Nevada dialogued with regulators, legislators, or their staff 61 times over two days regarding the following key issues:

Members of Congress shared that they will not be cosponsoring H.R. 3881/S. 1838, the Credit Card Competition Act (CCCA). Others committed to cosponsoring H.R. 4867, the Veterans Member Business Loan Act.

“Knowing that members of Congress and senators are taking positions that support credit unions is a testament to the difference advocacy makes within the halls of Congress,” said Stephanie Cuevas, senior vice president of federal government affairs for the California and Nevada Credit Union Leagues. “Our lobby-day started on a high note and ended on a high note.”

Ranking Member of the House Financial Services Committee Maxine Waters (D-CA) welcomed credit union leaders during a breakfast meeting. She thanked the crowd for credit unions’ commitment to financial inclusion and gave a special “thank you” to Kinecta FCU for opening a branch in an underbanked part of her district.

“Congresswoman Waters has shattered many glass ceilings as the first African American and first woman to serve as chair of the House Financial Services Committee,” Cuevas added. “Although her leadership can be a serious role, she also brought light and humor to the meeting by cracking some jokes and talking about her love of rap.”

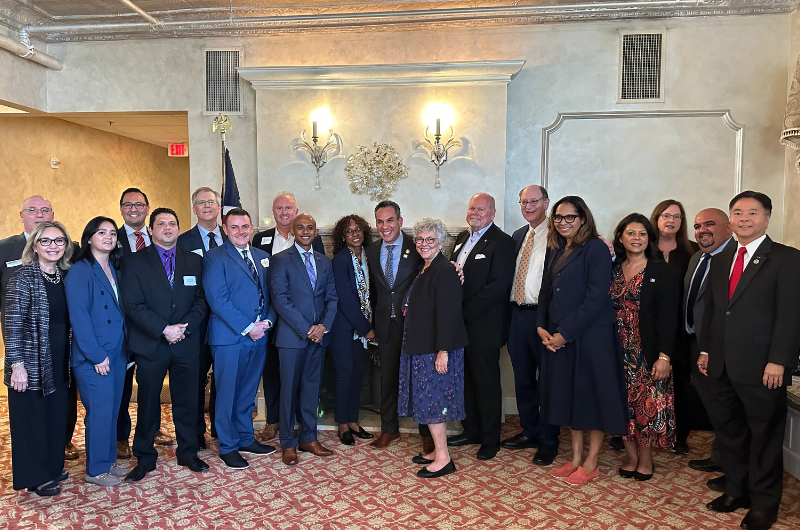

A political reception for Rep. Pete Aguilar (D-CA) and members of the New Democrats Coalition was also a great success. Sixteen members of Congress attended to show their appreciation of credit unions. This means Hike The Hill attendees had the unique opportunity to meet with members of Congress twice in one day.

“A huge ‘thank you’ goes out to all the incredible credit union leaders and individuals who joined us for Hike The Hill this year, demonstrating their unwavering commitment to advocacy,” Cuevas said. “Your participation not only made this event a resounding success but also showcased your dedication to the credit union difference. Thank you for being a driving force behind our advocacy endeavors, and may your continued support propel us into a bright future.”

2855 East Guasti Rd., Suite 202

Ontario, CA 91761

909.212.6000

1201 K. St., Suite 1050

Sacramento, CA 95814-3992

916.325.1360

c/o Great Basin FCU

9770 South Virginia Street

Reno, NV 89511-5941

202.638.5777 www.cuna.org

www.dfpi.ca.gov

Clothilde “Cloey” V. Hewlett — 415.263.8500

fid.state.nv.us

702.486.4120 (Las Vegas)

775.684.2970 (Carson City)