While a survey released this week shows how community bankers’ concerns about regulatory burden, monetary policy, future business conditions and future profitability have plummeted, it also revealed that 95 percent of those same respondents believe the U.S. economy is currently in a recession.

The community bank survey results are notable as California and Nevada credit unions of all sizes try to strategically plan for 2024 when it comes to an unpredictable economy, potential liquidity challenges, the inflation outlook, and so much more (register for this year’s two-hour online/virtual Your Economy—Your Credit Union conference).

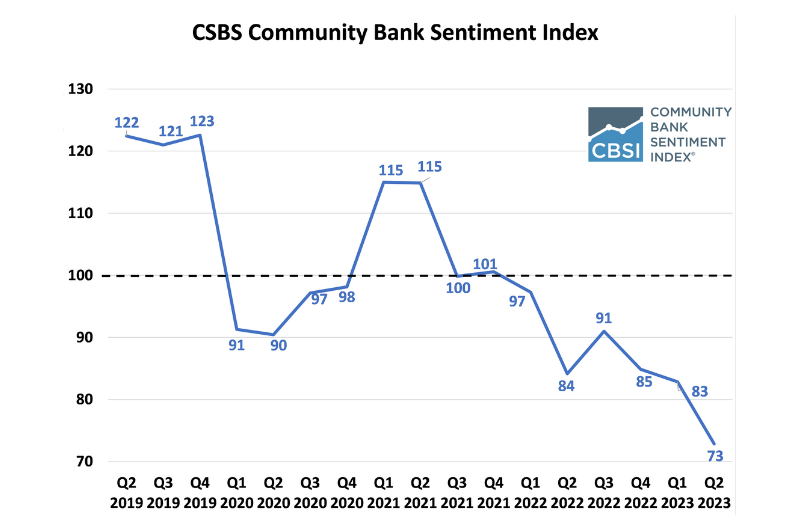

The ongoing survey — the Community Bank Sentiment Index, started in 2019 — was published by the Conference of State Bank Supervisors, a national association for state-chartered regulators. Highlights of the survey reveal that:

The Community Bank Sentiment Index is derived from quarterly polling of community bankers across the nation. As community bankers answer questions about their outlook on the economy, their answers are analyzed and compiled into a single number. Quarterly results are included in the Federal Reserve Economic Data (FRED), the online database maintained by the Federal Reserve Bank of St. Louis.

2855 East Guasti Rd., Suite 202

Ontario, CA 91761

909.212.6000

1201 K. St., Suite 1050

Sacramento, CA 95814-3992

916.325.1360

c/o Great Basin FCU

9770 South Virginia Street

Reno, NV 89511-5941

202.638.5777 www.cuna.org

www.dfpi.ca.gov

Clothilde “Cloey” V. Hewlett — 415.263.8500

fid.state.nv.us

702.486.4120 (Las Vegas)

775.684.2970 (Carson City)