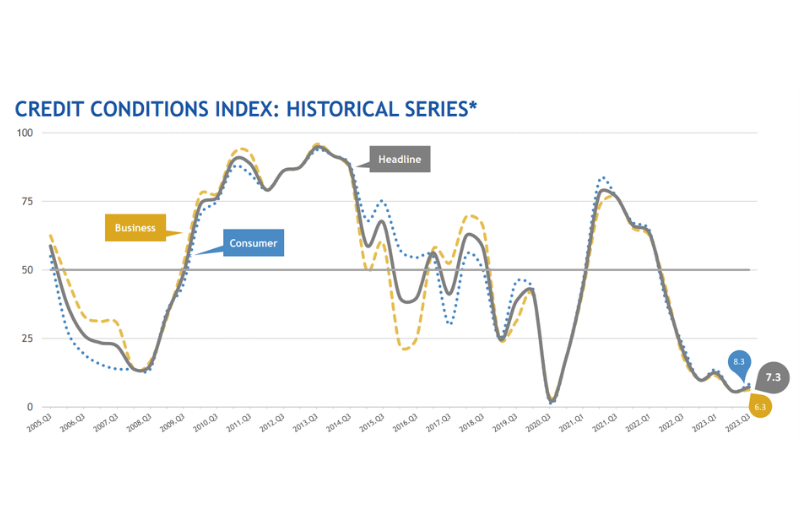

Economists working at the nation’s largest banks expect consumer and business credit conditions to soften over the remainder of 2023 due to the economic headwinds, according to a survey released this week. In fact, anticipations haven’t been this low since mid-2020 and are even lower than mid-2008.

The latest Credit Conditions Index summary released by the American Bankers Association examines a suite of indices derived from the quarterly outlook of chief economists from North America’s biggest banks. Readings above “50” indicate bank economists expect business and household credit conditions to improve, while readings below 50 indicate an expected deterioration.

Currently, most surveyed economists believe credit quality and availability will weaken over the next six months, with nobody expecting either of these metrics to improve this year. “While credit quality and availability have been remarkably resilient since the onset of the pandemic, recent index readings foretell softening credit conditions for both consumers and businesses,” a news release states. “Members expect that lenders will grow more cautious, particularly given elevated interest rates.”

At the same time, bank economists expect inflation to continue to ease, reducing the need for additional rate hikes by the Federal Reserve, it states. Underlying strength in the labor market will provide a buffer for consumers and businesses.

In the third quarter:

You can read the full report with detailed charts and a discussion of the broader economic context.

2855 East Guasti Rd., Suite 202

Ontario, CA 91761

909.212.6000

1201 K. St., Suite 1050

Sacramento, CA 95814-3992

916.325.1360

c/o Great Basin FCU

9770 South Virginia Street

Reno, NV 89511-5941

202.638.5777 www.cuna.org

www.dfpi.ca.gov

Clothilde “Cloey” V. Hewlett — 415.263.8500

fid.state.nv.us

702.486.4120 (Las Vegas)

775.684.2970 (Carson City)