Reducing Overdraft & NSF Fee Demand Letter and Litigation Risk

Debit Interchange Toolkit, CPPA, Call Reports, and Board Recap

League-Engaged Bills in Sacramento Drop or Move Forward

Personal Finance Bill Passes CA Assembly Education Committee

Debunking Health Plan Renewal Myths

Level up Your Data Leadership

On-Demand Webinar: Economists Prepare CUs for Summer & Fall

CA League Board Chair Passing Torch to Donna Bland

House Committee’s Resolution Voids CFPB’s CC Late Fee Rule

ANPR Feedback on Potential Records Retention Rules Update

Elevate Your CU’s Talent Management Strategy

What to Look for When Selecting an Audit Partner

FHFA: Letter to Congress, Report Implementation & Symposium

NCUA and U.S. Census Bureau Holding Webinar on Data Tools

Inclusiv Selected for $1.87B Grant from the EPA’s GGRF Fund

Oppose Overdraft Bill SB 1075 as it Heads to CA Senate Floor

April 22 ‘Economic & Industry Update’: Guiding CUs Into Summer

Future of CA, NV, and UT Associations & Member Credit Unions

Record Turnout at the California Government Relations Rally

The Power of Corporate Impact Investors for CUs

Research: Expectations & Concerns Drive Borrower Behaviors

‘Credit Union SACTOWN Run’ Raises $216,500 for CMN Hospitals

CA and NV CUs: $2.59B in Financial Benefits to Members in 2023

CFPB’s Chopra: Remarks on Data Protection and National Security

Leagues Submit Concerns on Proposed Overdraft Rule to CFPB

4 Indirect Lending Red Flags that Catch Examiner Attention

Your Voice Needed as CA’s Overdraft Bill Passes Senate Committee

Foundation Executive Director Announces Retirement: Dec. 31

NCUA’s Otsuka and CA & NV Leaders Meet on Important Issues

Events, Leadership Summit, CU Impact, Advocacy, Commitments

How Credit Union Members Can Expedite Their Tax Refunds

Give Your Members the Website they Deserve

Celebrating ‘Women’s History Month’ with Stephanie Cuevas

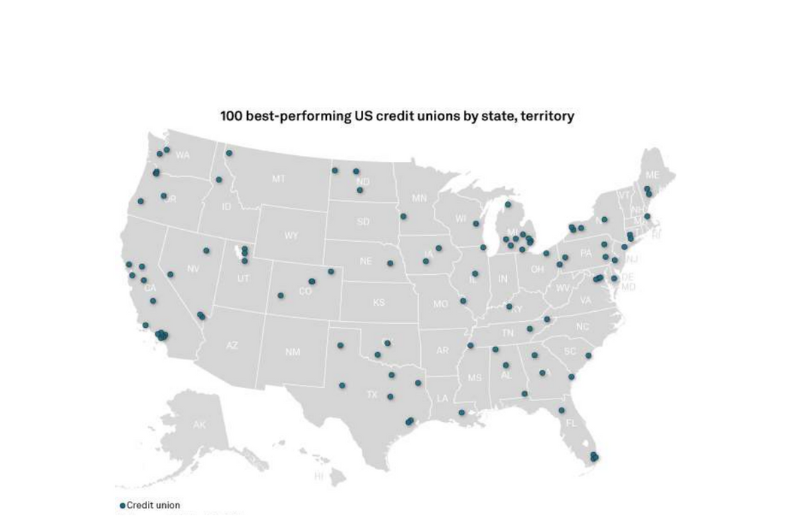

16 CA and NV Credit Unions Make S&P Global’s Annual List

Contact CA Senators to Oppose Overdraft and NSF Bill SB 1075

The Benefits of Managed Endpoint Detection and Response for Cybersecurity

A 4-Point Vendor Management Checklist to Mitigate Risk & Keep Employees Happy

‘Save Away for a Rainy Day’: CU Youth Month Materials Available

Celebrating ‘Women’s History Month’ with Crystal Price

CUs for Kids Wine Auction Raises Record $1.85M for 11 Hospitals

GAC Grand Sweepstakes: CA and NV CU Advocates Raise $62K

Please Amplify Your Voice on CFPB’s Proposed Overdraft Rule

The Future of Deposits: The Power of Corporate Impact Investors for CUs

The Real Cost of Contact Center Authentication: Security Costs

Designing Personalized Benefits Packages as Unique as Your Executives

Personal Finance Initiative Submits Signatures for this November

Leagues’ Sacramento Valley Network Hosts Influential CEO Panel

Celebrating ‘Women’s History Month’ with Ariana Balch

Op-Ed Spotlights $50 Billion Transfer to Retailers Under CCCA

Reps. Kim & Panetta Champion Letter to Fed on Debit Interchange

CA and NV Unemployment Rates Continue Higher Path than U.S.

Lawmakers & Regulators Hear One Unified Voice on Capitol Hill

New Cyber Incident Reporting Requirements for FICUs

Origence Lending Services Funds $6.38B in CU Loans in 2023

NCUA Vice Chair Engages with CA and NV Credit Union Leaders

League Sessions at GAC Fuel Attendees’ Momentum & Advocacy

Diana Dykstra Honored for Visionary Leadership by AACUL

Make Your Voice Heard: 2024 CA Government Relations Rally

Partnership FAQ: CA/NV Leagues & Utah Association Partnership

2023 Compliance Highlights & 2024 Forecast for CUs

CA and NV Leagues and Utah CU Association Form Alliance

‘This Industry Changes Lives’: Diana Dykstra Charts New Course

Celebrating ‘Black History Month’: A Conversation with Howard Smith

Deadline Coming: Lawmakers Can Sign-On to Joint Letter to Fed

FHLBank SF Accepts Mortgage Collateral to Expand Applicants

California AG Issues Letter on Overdraft and Returned Item Fees

Preparing for GAC: Agenda, Talking Points, and Resources

‘Interest Rate Risk at U.S. Credit Unions’: Insights & Opportunities

Unburden Your CU With Streamlined Vendor Management

3 Strategic Frameworks to Shape Your 2024 Strategic Planning

FHLB’s ‘Focus on Credit Unions’: Financial Environment & More

‘Evolution & Impact of AI in Credit Unions’: The Recap and Report

Executive Summary & CU Toolkit: Craft a CFPB Overdraft Letter

Temporary Vulnerability Discovered and Promptly Remedied

Inclusiv’s MDI & Cooperativa Learning Center, Grant Opportunity

Slowing Trends Foretell a Calmer, but Cautious, 2024 CU Outlook

Celebrating ‘Black History Month’: A Conversation with Joyce King

The New Firearms Merchant Category Code Legislation Impacts CUs

CA Bill Targets Overdraft & NSF at State-Chartered Credit Unions

New Research: 6 Consequences of Credit Card Competition Act

Report: Governance, Risk & Compliance Trends to Watch in 2024

WCMS Invites Professionals to Register for Academic Year

NCUA’s Harper: Overdraft and NSF Call Report Data Collection

Sen. Mike McGuire Sworn In as CA Senate President Pro Tempore

Celebrating ‘Black History Month’: a Conversation with Otis Clay

Four CA and NV Credit Union Leaders Ready to ‘Crash’ the GAC

Advocacy Supporters Collaborate at Workshop to Prepare for 2024

The Definitive Guide to Business Continuity and Disaster Recovery for CUs

Your Latest Quarterly CU Performance Report: Plan for the Future

Protect Overdraft Courtesy Pay: Contact Members of Congress

Beyond Limits: Transforming Member Experience With AI

AltaOne FCU Partners with PSCU/Co-op Solutions

CFPB’s Proposed NSF Rule: Highlights and Comment Deadline

Congressman Schiff Takes Lead Role in Senate Election Debate

NV Labor Force Reaches Record; CA Unemployment Hits 5.1%

CU FinHealth 24: Join Your Peers April 29 – May 1 in Aurora, CO

CFPB’s Proposed Overdraft Rule: Key Takeaways for Credit Unions

Latest Fraud Trends & Prevention Methods: What to Watch For & How to Take Action

Branch Exterior Crime is Rising – Stop Trends in Their Tracks

SCE CU and Mexican Consulate Expand Financial Inclusion in NV

2024 U.S. Economic Outlook and Its Impact on Credit Unions

Access Inclusiv & CDFI Fund Grant Program Assistance Webinar

Action Needed: Debit Interchange Survey Deadline is Today

Advancing C-Suite Diversity with 3 Mindful People Practices

Loan Maturity Bill: Leagues Thank Sherman, Kim, and Vargas

Helping Workers Rebuild Financial Strength after Historic Strike

Origence to Provide Affordable Financing for Electric Auto Buyers

CFPB’s Open Banking Proposal is Problematic for Credit Unions

UCU Commemorates New HQ and Advisory Center

Advocate for CUs at the 2024 Governmental Affairs Conference

America’s Credit Unions: One Unified, Powerful Voice Serving You

Microbusiness Explosion Exposes Risks & Opportunities for CUs

Merger Combines 2 Organizations into Leading Fintech Provider

Discover the Power of Advocacy During January 31 Workshop

Upcoming Events, Giving, CU Advocacy, and Leadership Summit

Helping CUs Respond: Overdraft Resources & Talking Points

CA Unemployment Hits 4.9%; More NV Residents Look for Work

Longtime Friend of Credit Unions Meets with League & Leaders

Dykstra Congratulates Otsuka; Thanks Hood for Service to CUs

Amplify Your Impact in 2024

CA League Endorses 2024 Financial Education Ballot Initiative

Credit Union Leaders Discuss San Diego-Area Economy’s Future

AACUL Winter Conference Deepens State Leagues’ Collaboration

How Embedded Finance is Shaping Financial Services

League InfoSight Launches CU PolicyPro & RecoveryPro Platform

Tom Kane Recognized with AACUL’s Highest Honor: Eagle Award

CEO Adds Credit Union Viewpoint to UCLA’s Economic Dialogue

The Benefits of Managed Endpoint Detection & Response for Cybersecurity

Best Practices for Credit Union Chief Risk Officers

Why Now is the Time for Insurers to Innovate

CDFI Certification Application: CU-Requested Changes Approved

CEO Jennifer Audette Honored at Sen. Portantino’s Luncheon

Dec. 20 Deadline: CDFI Small Dollar Loan Applicant Submissions

‘Credit Unions for Kids’ Recognized with Founders Award

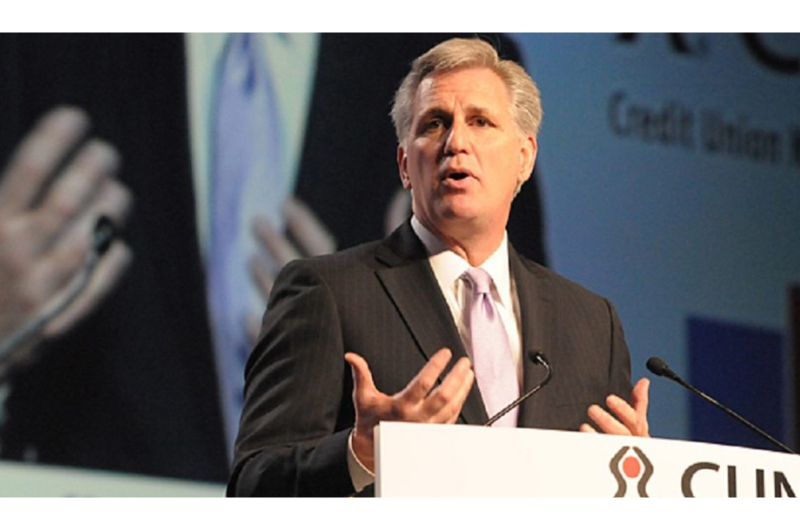

Thanking Kevin McCarthy for Unwavering Commitment to CUs

The Future of Payments and What It Means for Credit Unions

Leveraging Technology for a Seamless Member Experience

Become a Certified Credit Union Financial Counselor in 13 Weeks

Bay FCU Receives $3.7 Million in Funding to Support Members

2024 Planning Checklist: What’s Ahead for Your Governance, Risk & Compliance Initiative

How is Your CU Handling the New Cyber Incident Notification Rule?

The Faster Payments Era: New Channels and Expectations

CUNA Releases Detailed Analysis of FHFA’s FHLBank Report

Comunidad Latina and Patelco: Desjardins Adult Fin. Education

November Political Events Recap: Thank You to Participating CUs

No ‘Junk’ in Overdraft Fees; Only Transparent Consumer Options

The Importance of Cybersecurity Incident Responsiveness: Is Your Plan Ready to Be Tested?

Labor Force Churn in California and Nevada Continues

Leagues’ Bulletin: FHLB Analysis on Home Loan Bank System

Evolving to Meet Consumers’ Changing Needs

American Banker: Bland & Davis ‘Most Powerful Women’ in CUs

Why DIY Overdraft Programs Fall Flat

New Scrutiny on Autopay Cancellations

CrossState CU Association Partners with Leagues to Offer eTrain

Fed Proposes Significant Reduction in Debit Interchange Fee Cap

Leagues and CUs Build Upon Victories, Making a Powerful Impact

Co-op Solutions and PSCU Announce Intent to Merge

Loans Downshift, Loss Provisions Rise, and Deposits Limp Along

Dec. 19 Breakfast Reception for Congressman Adam Schiff

Historic Vote Sets up Transformation to ‘America’s Credit Unions’

Paying Tribute to Those in Credit Unions We Have Lost in 2023

CA & NV Board Officers Chosen as Annual Meetings Look to 2024

Building on Victories, CA League Engaged 40 of 2,800 Bills in 2023

Clark County Credit Union Revamps Audit Process with ViClarity

Safety and Security: How Technology is Driving the Future of Credit Unions

The CU’s Ultimate Guide to Improving Customer Service

‘REACH Sweepstakes’ Supports CULAC for Credit Union Cause

CA’s Unemployment Ticks Up; More Nevadans Looking for Work

SchoolsFirst FCU & Gallup Release ‘Financial Lives of Californians’

Board Recap: Cybersecurity, Insurance Rules, and Fair Hiring

Senator Laphonza Butler Appointed to Senate Banking Committee

Life Insurance Helps Ensure Tomorrow’s Certainty Today

Filene Report Summary: New Insights on ITIN Lending as a Driver for Growth

Data-Driven Insights: Uncovering the Secrets of Member Satisfaction

CA and NV Deposits Shrink $3.2B; Members Must Recalibrate Soon

Cheney and Dykstra: Please Support Worldwide Financial Inclusion

CA League and NV League Annual Business Meeting Details

CEOs Engage, Collaborate, and Network at ‘Mid-Sized CU Forum’

New Report: Removing Sales Tax from Interchange Calculations

Response to ‘Cherry Picked’ Overdraft Data in Politico Article

Oct. 19 ICU Day Webinar Spotlights International Perspectives

The Importance of Back Testing Your CECL Estimate

The Value of Asking “What Happens If?”

Register for NCUA and FTC Webinar: Protecting Credit & Identity

7th Annual Economic Forum: ‘Curious Case of Missing Recession’

Leagues Thank Kevin McCarthy for His Leadership and Service

Four Essential Elements of Branch Recovery

5 Steps for a Positive Impact on Fair Housing

USAA Remote Deposit Capture Technology Infringement Update

Leagues Monitor Events as ‘Politico’ Piece Targets California CUs

Former CA Regulator Supports FHLB as FHFA Releases Report

CUNA and NAFCU Provide Updates on Proposed Merger Website

Senate Banking Committee Passes Cannabis Banking Bill

Updates: Events, Awards, ICU Day, Planning Session, & Advocacy

Local CU Leaders Discuss Central Valley Economy’s Future

Government Shutdown Talking Points for CU Staff and Members

Promote ‘International Credit Union Day’ with These Resources

Is Your CU Ready for the New Cyber Incident Notification Rule?

Applications Due October 12: Green Grants for Green Loans

2 CA Leaders Named ‘CU Rock Stars’ by Credit Union Magazine

Three CUs Share Tactics to Drive Economic Empowerment

Passionate Leaders Engage with Lawmakers & Regulators in D.C.

Outcome for CUs as CA Legislative Session was Adjourned

Dean Michaels Named President/CEO of Co-op Solutions

Predatory Lending in the Digital World

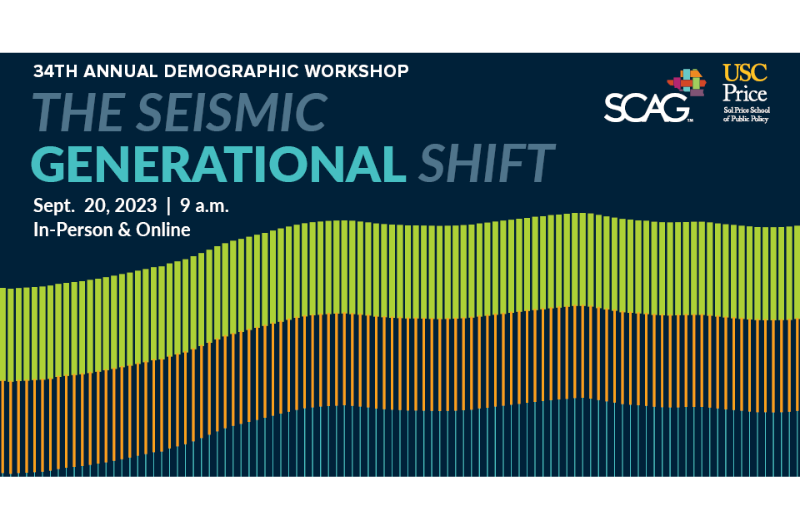

Report Provides Demographic, Economic, & Housing Update

‘2Q 2023 Quarterly Credit Union Performance Report’ Released

CA and NV ‘AHEAD’ Grant Recipients Receive Nearly $1 Million

League-CUNA Breakfast Reception for Congressman on Oct. 10

Western CUNA Management School’s Key Leadership Changes

Make Your CU’s Voice Heard Immediately on Interchange Bill

CA’s Job Market Steady; More Nevadans Looking for Work

NV Bill: Prohibit Reduction in Liability Limits by Defense Costs

California CUs: Remain Diligent on ‘Public Bank’ Gatherings

Deadline is Today for Voicing Interest in ‘Green Loan’ EPA Grants

Save the Date: 2023 Joseph A. McDonald Attorney Conference

Utilizing Member Experience Data in CU Marketing Strategies

2023 League & Advocacy Award Recipients: Ceremony at REACH

Gov’s AI Order; CPPA on Cybersecurity Audit & Risk Assessment

Leagues Launch Inaugural ‘Mid-Sized CU Forum’ on October 11th

Warming Up to Solar Lending: The Need & Business Case for CUs

Support Strong Dual-Charter System: Submit Feedback by Oct. 5

How Credit Unions Can Achieve Internal Alignment for Success

Sept. 26 Webinar: When Life Happens, Be There for Your Members

Clark County CU CEO to Serve on NV State Infrastructure Bank

Update on Six California Bills with Implications for Credit Unions

Sen. Mike McGuire to Succeed Toni Atkins as Senate President

NV League Discusses CU Priorities with Sen. Rosen & Rep. Lee

Vote on CUNA-NAFCU Merger Proposal: ‘America’s Credit Unions’

‘FedNow’ Town Hall Recorded Webinar Will be Available Soon

Small CUs Network, Engage, and Learn at the ‘Shapiro Summit’

Watch Recording: CU Experts on 2024’s Economy, Rates, & More

Automating Vendor Risk Mitigation to Empower & Prepare Your Business

Embrace an E-Commerce Mentality to Drive Member Experience

Harness the Power of Your Data

New York Times Features SAFE CU Member and Wealth Expert

CoastHills CU Celebrates $3M in Grants from CDFI Fund

Benefits of Managed Endpoint Detection & Response for Cybersecurity

Q3 Compliance Town Hall Webinar: Key Elements for a Successful Overdraft Program

Maximizing Acquisition Strategies Through Data-Driven Insights

CA’s Labor Force Dips; NV’s Non-Farm Jobs Hit New Record

FFIEC Publishes Yearly Localized Median Family Income Report

Member CEOs: Please Vote for a Candidate in Contested Race

Leagues Recognized as a ‘CHOC Gala Champion Honoree’

New ‘Compliance Corner’ Supplements our ‘Compliance Hotline’

Annual Deposit Growth Plummets to Near Historic Low

How to Achieve Buy-In for Your Member Experience Program

California DFPI’s Cybersecurity Threat Briefing on August 18

NCUA Issues Guidance on Cyber Reporting Rule for FICUs

NCUA’s August 24 Webinar on Credit Union League Partnerships

CUNA Urges Parity and Files Motion to Intervene in Court Ruling

Regulators Release BSA/AML Examination Manual Updates

CFPB Sues ‘USASF Servicing’ for Disabling Vehicles and Billing

NCUA Issues Reminder on ECOA Requirements & Regulation B

Home Loan Bank CEO: Leveraging Membership, Liquidity, & More

InfoSight Releases Toolkit to Help CUs Prevent Elder Abuse

Transition Board for ‘America’s Credit Unions’ Announced

Emergency in Maui: Use ‘CUAid’ to Help CUs Impacted by Wildfires

#ILoveMyCreditUnion Day Reaches 9 Million People

Golfers Raise $90K for RMJ Foundation’s Fin. Education Efforts

Cryptocurrency and CUs: Evolving Use Cases and Regulation

Three Strategies for SBA Program Success

FIS Improves Client Experience

Leagues Welcome Amanda Merz: VP of Impact & Development

Meeting with State Lawmakers: Davies, Blakespear, & Bruce-Lane

Nevada Credit Unions See Wins & Victories Throughout 2023

Golden 1 CU to Invest $10 Million in Under-Resourced Community

2023 World Credit Union Conference Sees Record Attendance

California Credit Union League Legend’s Journey Started in 1954

Proposed Merger Between CUNA-NAFCU: Details & Information

USCIS Publishes Revised Form I-9 Documents for Immediate Use

Five California CUs Win State-Level CUNA Awards

10 Ways CUs Can Get More Appointments Scheduled

Credit Union System as a Service

NCUA: Agencies Update Guidance on Liquidity Risks and Contingency Planning

The Changing Skillset of the Credit Union CEO

3 Things Vendor Management Must Deliver to be Successful

ViClarity Simplifies GRC for Financial Institutions

TODAY: CU Awareness #ILoveMyCreditUnion Day

2023 WCMS Graduates Honor & Celebrate Credit Union Movement

CFPB Finds Unfair, Deceptive & Abusive Acts in Consumer Financial Products

FCU Member Expulsion Final Rule; 2023 Mid-Session Budget

Register Today for the Shapiro Summit from August 25 – 26

Assessment Rate, IT Survey, PMI, Crypto Scams, & Mortgage Data

New CCPA Investigatory Sweep for CA Employers Announced

13th Multi-Network PAC Golf Tournament Raises Over $131K

Self-Assessment Available: Measure Your CU’s Member Experience

Support CU-Friendly Legislators & Candidates at These Events

Certain PMI Requirements Waived for State-Chartered CUs

Actions vs. Words: Singleton Challenges Leaders at ‘Philosophy Night’

Interchange Bill: ‘True Cost’ Report, Congress, and NDAA Update

2023 Mid-Session Budget & FCU Member Expulsion Bylaws

Strategically Plan for 2024: ‘Your Economy—Your Credit Union’

Coming July 28: Sign Up Today for #ILoveMyCreditUnion Day

NCUA to Host Aug. 2 Webinar: New Cyber Incident Reporting Rule

Best Practices in Fighting for CUs at the ‘Advocacy Roundtable’

Upcoming Events, Updates, League ‘Networks’ Near You, & More

Four Essential Elements of Branch Recovery

FIS On the Ready to Support Fed’s New Instant Payment Service

Maximizing Acquisition Strategies Through Data-Driven Insights